Why Choose a Professional Virtual Bookkeeper?

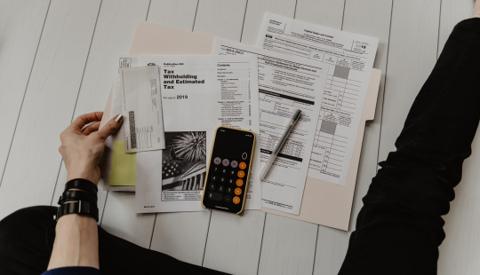

When you hear the terms accounting system, cash flow, assets, liabilities, invoicing, and monthly financial statements, “complicated” is probably the first thing that comes to mind. And you’re right. These terms could somehow be intimidating especially for those who don’t have that much background in accounting or bookkeeping.

Still, whether you have knowledge in bookkeeping or not won’t change the fact that as a business owner, it’s a must in running your business. Small businesses to big corporations, even for non-profit organizations- bookkeeping is very much needed.

Instead of juggling financials yourself or hiring a part-time bookkeeper with limited expertise, outsourcing to a virtual bookkeeping service gives you:

- Confidentiality and accuracy

- Error-free financial statements

- QuickBooks bookkeeping setup & monthly maintenance

Whether you run a small business or an ecommerce store (Shopify, Amazon FBA, WooCommerce), our outsourced bookkeeping services simplify the process and give you peace of mind. Doing so will not only guarantee you confidentiality, but will also provide the expertise you need in handling your financial reports.